Crypto trading is as much about managing risk as it is about chasing gains. Whether you’re a beginner learning the ropes or a seasoned analyst seeking efficient execution, understanding How to Use Stop-Loss and TP on OKX can make all the difference. This step-by-step guide dives deep into these essential tools, showing you practical workflows, explanations, and smart strategies to use on the OKX exchange (referral code: CRYPTONEWER) for maximum benefit.

What Are Stop-Loss and Take Profit?

Before you place your next trade, let’s define these two crucial terms:

- Stop-Loss (SL): An automatic order to sell your crypto position when its price drops to a specified level. It’s your toolkit for limiting losses and protecting your capital during volatile market swings.

- Take Profit (TP): An automatic order to sell a position when it hits a price where you wish to secure profits. This removes emotion from the selling process and lets you cash in on your plan.

Both are vital for a sound trading plan, eliminating emotional decision-making and safeguarding your returns.

Why Use Stop-Loss and TP on OKX?

Trading on OKX, one of the world’s leading crypto exchanges, brings advanced tools and a seamless order interface. Here’s why using Stop-Loss and Take Profit on OKX is smart:

- Minimize Losses: Don’t get caught in rapid downturns – set your limits ahead of time.

- Lock In Gains: Secure the profits before the market turns back.

- Maximize Discipline: Stick to your trading strategy and avoid panic selling or FOMO.

- Ease of Use: OKX provides intuitive interfaces, customizable order types, and reliability trusted by millions.

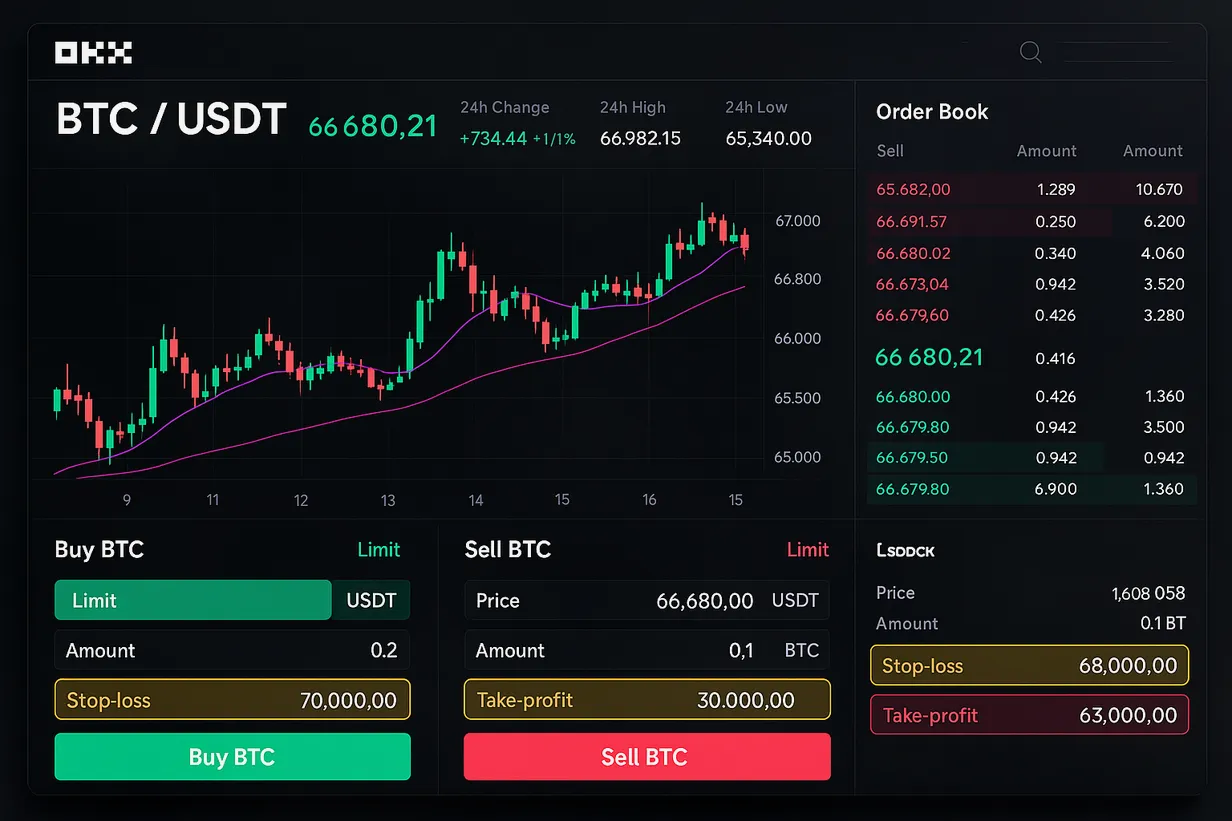

Step-by-Step: Setting a Stop-Loss and TP on OKX

Let’s go through the process together:

1. Log in and Select Your Trading Pair

- Visit OKX and register with code CRYPTONEWER to unlock exclusive benefits.

- Navigate to the trading dashboard and select your desired crypto pair.

2. Choose the Order Type

On OKX, you can use Advanced Orders such as:

– Limit orders

– Market orders

– Conditional orders (Trigger orders)

Choose the type best suited for your strategy. Most users combine Limit or Market with Stop-Loss/TP triggers.

3. Set Your Stop-Loss Level

Determine the price at which you want your trade to be closed to protect your investment:

– In the order panel, look for ‘Advanced’ or ‘Stop-Limit/Stop-Market’ tabs.

– Input your stop price (the trigger) and limit/market price (executed price).

– Example: If you buy BTC at $50,000, but want to risk only 5%, set SL at $47,500.

4. Set Your Take Profit Target

- In the same panel, enter your desired profit level.

- The exchange will automatically execute your TP order once your target price is met.

- Example: Set TP at $53,000 for a 6% gain.

5. Confirm and Monitor

- Double-check all your inputs for accuracy.

- Click ‘Place Order.’

- Monitor your position. You’ll see your order in the ‘Open Orders’ section.

6. Modify or Cancel as Needed

OKX lets you adjust or cancel your stops and targets before they trigger. Stay agile as the market changes!

Pro Tips for Setting Effective SL and TP

- Base your levels on support/resistance or technical indicators, not emotion.

- Avoid overly tight SLs to reduce premature stop-outs.

- Analyze volatility: Set a wider SL during fast-moving markets.

- Always plan TP before you enter a trade!

- Backtest your strategy with historical data on OKX’s testnet or simulator.

Learn and Earn with OKX

New to OKX? Sign up with promo code CRYPTONEWER using this special link to access trading bonuses and exclusive features. You’ll get hands-on with powerful order types and boost your trading results from day one.

Common Mistakes to Avoid

- Placing SL/TP too close to current price

- Forgetting to set orders in high volatility periods

- Not reviewing order status during big news or events

Getting familiar with these powerful risk controls is crucial for any crypto trader. Managing your portfolio smartly on OKX will give you the confidence and results you’re aiming for.

Ready to trade smarter? Join OKX with code CRYPTONEWER and unlock a safer, easier way to maximize your crypto experience.