If you’ve ever wondered what you really pay each time you trade on OKX, this guide breaks it down in plain language. With OKX’s multi-product lineup—spot, margin, futures, perpetual swaps, and options—fees can look complex at first glance. The good news: once you understand maker vs. taker pricing, VIP tiers, and OKB-based discounts, it becomes straightforward to optimize costs and keep more of your PnL.

Want a head start? New users can join through this referral and explore welcome perks: OKX using code CRYPTONEWER.

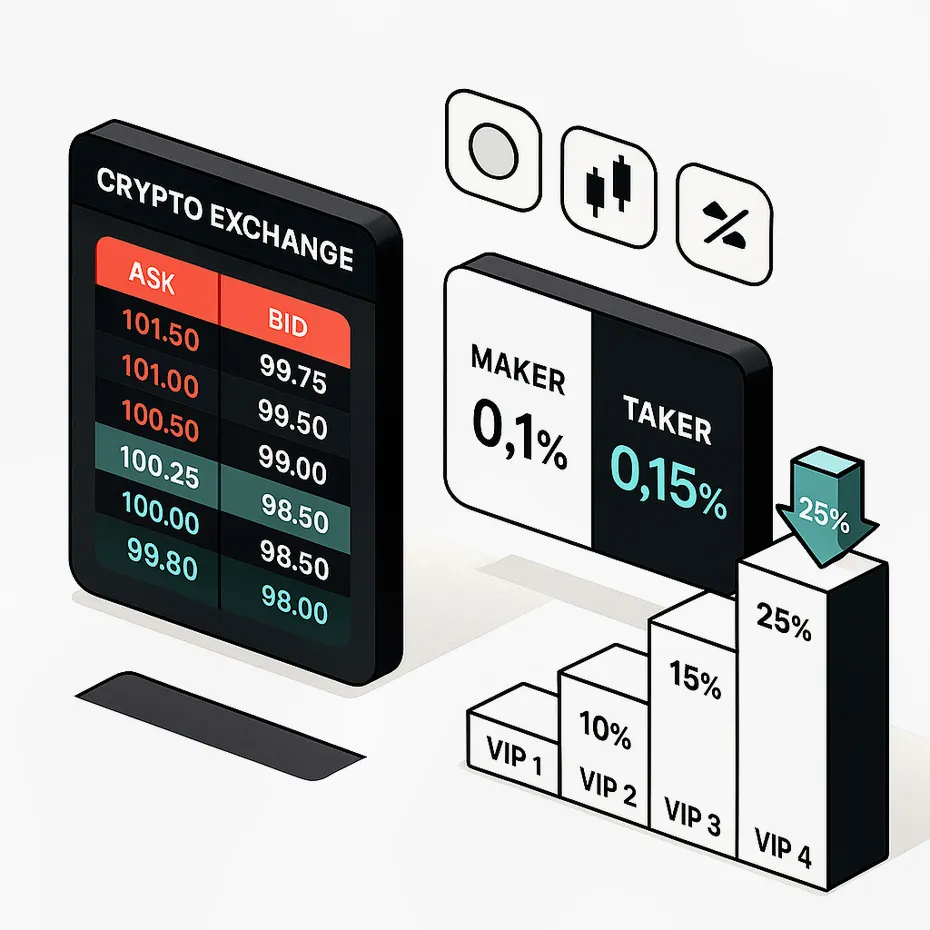

What “maker” and “taker” fees really mean

- Maker orders add liquidity by posting a limit order that doesn’t instantly execute. These typically cost less.

- Taker orders remove liquidity by matching an existing order on the book—market orders and marketable limit orders are takers. These usually pay a higher fee.

Why it matters: placing thoughtful limit orders can materially reduce your effective fee rate, especially at higher volumes.

OKX fee pillars at a glance

OKX employs a tiered fee model across products. While exact figures can change, the framework is consistent:

- Spot trading usually charges a lower rate for makers and a slightly higher rate for takers.

- Derivatives (futures and perpetual swaps) often feature maker fees that are lower than spot, with taker fees still higher than maker.

- Options trading follows a similar maker-taker pattern, with product-specific nuances.

- VIP tiers and OKB holdings can reduce these fees further, sometimes significantly for high-volume traders.

As a directional reference only (check the live schedule in your account for the latest):

- Spot base tier has commonly been around maker ~0.08% and taker ~0.10%.

- Perpetuals/futures base tier has commonly been around maker ~0.02% and taker ~0.05%.

- Options base tier has commonly been around maker ~0.02% and taker ~0.03%.

Note: These example ranges are for context, not a quote. Actual rates depend on your current tier, product, and any active promotions.

VIP tiers and volume-based pricing

OKX aggregates your 30-day trading volume (USD equivalent) to determine your VIP level. As your volume rises, your fee tier improves, lowering both maker and taker rates. Key elements:

- Tiering is dynamic. Your level updates as your rolling 30-day volume changes.

- OKB holdings can unlock additional discounts on top of your tiered rate.

- Institutional-level volumes can qualify for very competitive rates and even special liquidity programs.

Pro tip: If your trading is spread across multiple accounts, consolidating volume (where appropriate) can help you reach better tiers faster.

OKB-based discounts

Holding OKB, the OKX ecosystem token, may qualify you for reduced fees. This typically works via tiers linked to your average daily OKB balance. The more OKB you hold (within published thresholds), the better your discount band. OKB discounts can stack with your VIP tier, carving down your all-in costs.

Reminder: Token prices change. Consider both the fee savings and the portfolio risk when deciding how much OKB to hold.

Product-by-product breakdown

While each product category shares common fee logic, there are details worth noting.

1) Spot trading

– Maker vs. taker: Makers pay less; takers pay more.

– Pairs: Fees can vary by pair liquidity and your tier.

– Fee currency: Fees are generally deducted in the asset you receive or as designated in your account preferences.

2) Margin trading

– Trading fee: Follows spot maker/taker logic.

– Interest: Borrowed funds incur interest, calculated separately from trading fees. Your net cost = trading fee + margin interest (minus any promotions).

3) Perpetual swaps and futures

– Trading fee: Maker/taker rates typically lower than spot in base tiers.

– Funding rate (perps only): Not a “fee” to the exchange, but periodic payments exchanged between longs and shorts. Positive funding means longs pay shorts; negative funding means shorts pay longs. This cost/credit is independent of trading fees.

4) Options

– Trading fee: Maker/taker structure with product-specific rates.

– Exercise/assignment: Some exchanges charge additional costs or minimum fees on exercise/assignment; check OKX’s live rules for current terms.

5) Convert and block trading

– Convert: Often marketed as zero-fee conversion, but implied costs can show up in the spread. Useful for simple swaps, less so for precision entry/exit.

– Block trading: Negotiated pricing for large orders; the fee framework may differ based on liquidity and counterparty.

6) P2P and fiat on-ramps

– P2P: Typically fee-light for takers; merchants or advertisers may face separate terms.

– Third-party payment processors may charge service fees for card buys, bank transfers, or other on-ramp methods.

Hidden costs many traders overlook

- Slippage: Market orders can pay more than the posted taker fee when price impact is large.

- Spread: A tight spread saves you more than a tiny fee discount in many scenarios.

- Funding rate (perps): Can dwarf the trading fee over time.

- Margin interest: For leveraged spot, interest compounding matters.

- Withdrawal network fees: Not charged by OKX as a revenue line in most cases; it’s a blockchain miner/validator cost, but it’s still part of your all-in cost to move assets.

Example calculations

Below are illustrative examples using common base-tier ranges. Your actual rates depend on your tier and discounts.

1) Spot taker example

– Trade: Buy $10,000 of BTC/USDT as a taker.

– Fee rate: Assume 0.10% for a base-tier taker.

– Fee: $10,000 × 0.001 = $10.

– If you instead post a maker order at 0.08%, the fee becomes $8.

2) Perpetuals maker example

– Trade: Open a long position with $250,000 notional on BTC perpetuals as a maker.

– Fee rate: Assume 0.02% maker.

– Fee: $250,000 × 0.0002 = $50 to open; closing the position incurs another fee at close.

– Funding: If the funding rate is +0.01% for 8 hours and you’re long, you’d pay $250,000 × 0.0001 = $25 that period. Over multiple intervals, funding can outsize trading fees.

3) Options taker example

– Trade: Buy 20 BTC call options at a premium of $500 each as a taker.

– Notional premium paid: 20 × $500 = $10,000.

– Fee rate: Assume 0.03% taker.

– Fee: $10,000 × 0.0003 = $3.

– Outcomes: If you exercise or get assigned, check live rules for any exercise-related charges.

How to pay less on OKX fees

- Use maker orders when practical: Post limit orders to pursue the lower maker rate. Partial fills still count; any portion that executes immediately is typically charged as taker.

- Build volume strategically: Higher 30-day volume unlocks better VIP tiers with lower rates.

- Consider OKB holdings: If it aligns with your portfolio strategy, OKB-based tiers can add meaningful discounts.

- Time and liquidity: Trade in liquid hours and pairs to reduce slippage and spread costs. A narrow spread can save more than a small fee reduction.

- Net down your transfers: Plan withdrawals to reduce frequency, amortizing network fees over larger amounts.

- Evaluate product choice: For directional bets, compare perps vs. futures vs. options; the total cost includes fee, funding/interest, and spread.

- Track funding: If you run carry strategies or hold perps long-term, funding dominates. Choose the side and timing accordingly.

- Use the referral for potential perks: Sign up through OKX with code CRYPTONEWER to access welcome offers and potential fee reductions as published by OKX.

Frequently asked questions

Q: Are fees the same for every user?

– No. They vary by product, maker/taker status, VIP tier, and OKB discount eligibility.

Q: Do perps have extra fees beyond trading fees?

– Perpetuals have funding payments between longs and shorts. That’s separate from exchange trading fees.

Q: How do I know my current tier?

– Log into your OKX account; the dashboard shows your 30-day volume and current fee tier. It’s updated dynamically.

Q: Is Convert really free?

– Convert may not show a line-item fee, but an implied spread applies. For precise entries, compare order book pricing on spot.

Q: What about withdrawals?

– You’ll pay a blockchain network fee determined by congestion and the chain you choose. OKX typically passes this through; it’s not the same as a trading fee.

Q: Do I get discounts for holding OKB?

– Yes, OKB-based tiers can provide additional reductions on top of your VIP level, subject to OKX’s live schedule and conditions.

Smart workflow checklist for minimizing OKX fees

- Decide entry style: Can you patiently place maker orders instead of crossing the spread?

- Choose the right market: Spot vs. perps vs. options, after comparing total cost of carry.

- Monitor funding: If using perps, track funding windows and consider hedges.

- Build volume with intent: Consolidate trades to progress your tier (if sensible for your strategy).

- Consider OKB: Balance fee savings against token exposure.

- Reassess regularly: As volatility, liquidity, and tiers change, so do your optimal tactics.

Why a structured fee strategy compounds over time

Short-term traders might focus on spread and fill probability, while swing traders and investors may weigh funding and interest costs more heavily. Regardless of style, fee discipline compounds:

- Lower maker rates and tighter spreads improve average entry/exit quality.

- Fewer, larger transfers reduce blockchain costs per dollar moved.

- Tier upgrades and OKB discounts act like permanent APR reductions on your trading activity.

If you’re getting started or opening a new account, secure your on-ramp and potential welcome offers here: OKX with referral code CRYPTONEWER.

Key takeaways in plain English

- The OKX Trading Fee Structure Explained: maker orders are generally cheaper than taker orders; tiers and OKB holdings can cut costs further.

- Total cost > headline fee: Include spread, slippage, funding, interest, and network fees.

- Simple changes matter: Place more maker orders when feasible, consolidate volume, and consider OKB for discounts.

- Stay current: Fee schedules can change—always verify rates in your account before executing large strategies.

Your trading edge is the sum of small advantages. Understanding the OKX fee model—and engineering your process around it—is one of the cleanest, least risky edges you can build into your daily routine.